Spending on a car is the second biggest expense in the family budget, reveals Serasa

[ad_1]

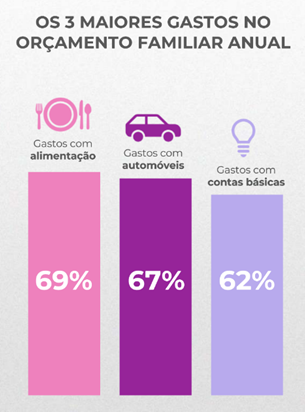

To assess the importance of cars within the family budget, Serasa carried out the second edition of the survey “The Brazilian Relationship with the Car”. Produced in partnership with the Opinion Box Institute, the study found that only spending on food (69%) exceeds the impact of vehicles on the pockets of drivers and families.

According to the survey, which interviewed 2,023 respondents in December, 67% of Brazilian households have car costs among their three biggest annual expenses. Vehicle costs are second only to food (69%) and are ahead of expenses with basic bills, such as water, electricity and gas (62%).

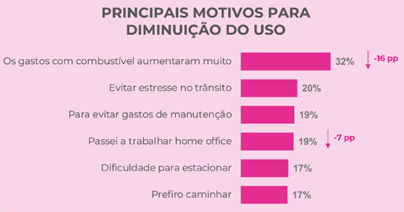

Among the most common car functions for Brazilians are shopping and daily tasks (77%), weekend trips (76%) and getting to work or school (64%). In relation to the first edition, the growth of 7 percentage points in the use of cars for tourist trips (49%) stands out.

However, the financial organization related to car costs still appears as a matter of conflict for drivers: 31% admit to spending more on the vehicle than initially planned, 92% have already suffered from some unexpected cost related to the use of the car and 62% have an emergency fund – among the most common emergency expenses are related to tire changes or repairs (51%), mechanical repairs (48%) and mileage checks (35%).

“Establishing expense monitoring and maintaining an emergency fund are essential habits for dealing with setbacks,”

warns Ana Carolina Ribeiro, coordinator of Serasa.

“One tip is to write down all fixed costs, defining a specific budget for the car throughout the year, and saving a portion for unforeseen events. In addition to saving for future plans, it is also possible to have more peace of mind to cover emergency expenses.”

IPVA 2024

Charged annually, the Motor Vehicle Ownership Tax (IPVA) corresponds to the amount that must be paid by all vehicle owners. Even though it is a traditional expense for the period, the study reveals that 11% of owners had not yet planned, in December, to pay the 2024 IPVA.

“In line with the complexity of the financial organization revealed by drivers throughout the year, even though it is a recurring expense at the time, the amount tends to take some drivers by surprise”,

says Ana Carolina.

“Thus, financial planning is essential to measure expenses in advance and estimate costs between one year and the next”, he adds.

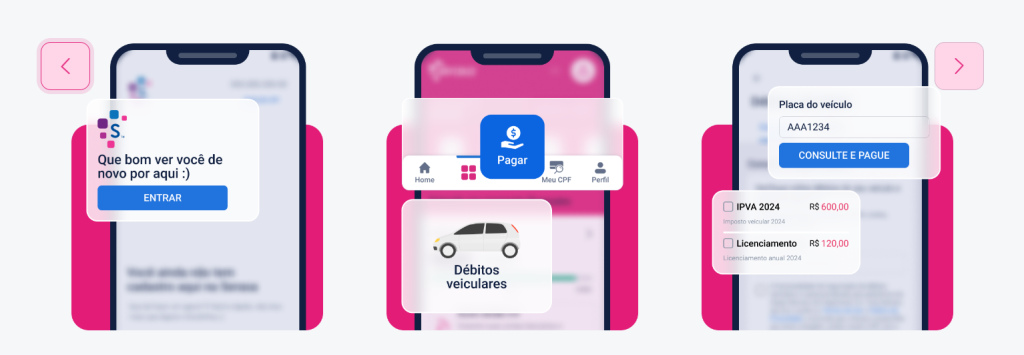

Using the Serasa Digital Wallet, consumers can pay IPVA more safely, in addition to finding special conditions. “On the Serasa platform, it is possible to make payments via Pix or credit card, in addition to paying in up to 12 installments, easing the budget”, explains Ana.

How do I pay my IPVA through the Serasa Digital Wallet?

1st Step – Download the Application

If you don’t already have the Serasa App on your mobile device, download it from Google Play or Apple Store, enter your CPF and fill out a brief registration form.

2nd Step – Access the payments area

In the bottom menu of the screen, click on “Pay” to access the payment options available in your Serasa account. Next, click on the “Vehicle Debts” option.

3rd Step – Access the vehicle area and locate your vehicle

To check IPVA and other charges, enter the car’s license plate. Wait for the debts to appear on the screen and select the options you want to pay.

4th Step – Complete the payment

Click on “Pay now”, choose the best payment method and whether you want to pay in full or in installments.

Digital Wallet offers a variety of financial solutions

The Serasa Digital Wallet is a secure way to carry out banking transactions in one place, allowing bills to be paid in up to 12 installments.

By logging in, it is possible to access invoices more easily, for those who want to organize and pay their water, electricity, gas bills and receive alerts about invoices issued in their name (such as online purchases or vehicle debts). With no maintenance fee, the service also provides consultation and payment of vehicle debts without leaving home.

For more information: www.serasa.com.br.

*With information from consultancy

Read more:

IEL Amazonas wants to expand the insertion of young talents into the job market in 2024

“Any person or company can have their forest in the Amazon”, reveals CEO of Meu Pé de Árvore

Cieam launches Competitiveness Commission to strengthen the industry in Amazonas

[ad_2]

Source link

:strip_icc()/s02.video.glbimg.com/x720/12519489.jpg)